The Twilight of Industrial Society

Leslie Evans

I spent several days at the end of May on a farm in the Appalachian Mountains near Artemas, Pennsylvania. Some 180 people had gathered there for a conference billed as The Age of Limits: Conversations on the Collapse of the Global Industrial Model. Most had driven in from the Eastern seaboard, camping in little dome-shaped tents in the dense forest that fills the majority of the 165 acre Four Quarters InterFaith Sanctuary. Four Quarters is nominally a church. Scattered around the property are little altars – to the Indian elephant god Ganesh, the Buddha, and other deities. The central spiritual focus is its Circle of Standing Stones, forty-two 10,000 pound monoliths set upright in a half circle, erected with volunteer labor over the last seventeen years. They plan to complete the circle in the decade to come. The sanctuary is off the grid, provides its own electricity (shut off at night), and grows most of its own food on thirty acres of arable land. The operation’s patriarch, Orren Whiddon, a fifty-five-year-old retired mechanical engineer, oversees a first-rate machine shop on the premises that makes replacement parts for people in nearby towns.

I heard of the conference from a posting on the Energy Bulletin website ( www.energybulletin.net ) of the Post Carbon Institute, a think tank in Santa Rosa, California, devoted to the study of natural resource depletion, particularly of oil, climate change, and limits to economic growth. Four of the most prominent writers on peak oil and the threat it poses to the world economy were scheduled to speak: John Michael Greer, author of The Ecotechnic Future: Envisioning a Post-Peak World ; Tom Whipple, a retired CIA analyst who is editor of the daily Peak Oil News and the weekly Peak Oil Review, both published by the Association for the Study of Peak Oil-USA; Gail Tverberg, who writes widely under the title Gail the Actuary and maintains the website Our Finite World ( www.ourfiniteworld.com ); and Dmitry Orlov, a Russian-born author who witnessed the collapse of the Soviet Union and predicts a similar fate for the United States.

I read all of these people regularly and couldn’t resist the chance to meet them in the flesh. The road there was a bit long – I was one of only two people from the West Coast. It involved a plane to Minneapolis, then another to Baltimore, and on in a rental car for a 125 mile drive up into the Pennsylvania Appalachians. I packed an ultralight sleeping bag in my suitcase, and reserved one of the limited spaces in the farm’s bunkhouse, for a nominal $10 a night.

I should say at the outset that most people don’t pay any attention to, or take seriously, the threat of declining fossil fuels, except as it shows up in prices at the gas station, which are still far from prohibitive. The idea that our society could collapse outright because oil becomes too scarce or too expensive seems like just one more of those dystopian notions the movies and science fiction are full of. The most plausible and often portrayed include nuclear war and megaplagues. Less likely are sudden drastic changes in the earth’s climate, meteor strikes, alien invasions, and, at the bottom of the barrel, brain eating zombies, giant ants, and the pod people. Because most of these are improbable or impossible doesn’t mean there aren’t real civilization-destroying perils in our future. The most threatening arise from our uncontrolled population growth and insatiable use of natural resources on a finite planet that is reaching its limits.

Most of us know that we are in the early stages of a human-caused rise in the earth’s temperature that is already producing droughts, floods, wildfires, and flooding of low-lying areas, and is likely to make large parts of the planet uninhabitable in a century or little more. Hitting the world’s limits on oil production is also already in its early stages, and those scientists who follow this are inclined to think that it will hit in full force much sooner than the worst of global warming. James Hamilton, an economist at UC San Diego, in a paper for the Brookings Institute says that rising oil prices were a greater cause of the 2008 economic crash than the housing bubble.

World output of cheap oil, on which our civilization depends for transportation, lubricants, fertilizer, plastics, and many other necessary products, flatlined in 2005, acknowledged in November 2010 by the Organization for Economic Cooperation and Development’s International Energy Agency, which projects that global crude oil production will never again reach its 2005 level. We are now making up the difference from extremely expensive and environmentally destructive sources – deepwater, tar sands, fracked shale, and corn ethanol. And there are good reasons to believe that these “unconventional” sources cannot be produced in sufficient volume to make up for the growing shortfall in ordinary crude. The UK Industry Taskforce on Peak Oil and Energy Security in its 2010 report projected that world oil production would hit its peak within ten years and possibly by 2015. The Age of Limits conference sought to look at the consequences we face and discuss our options.

What distinguished all the speakers (because of back-to-back scheduling I did not get to hear psychologist Carolyn Baker) was agreement that no foreseeable alternative energy source is on the horizon to replace fossil fuels, particularly for transportation, and that our societies would have needed to begin scaling back energy use thirty or forty years ago to prepare a soft landing. None did. John Michael Greer commented in his blog a few days after the event that “it started from the place where most other peak oil events stop, with the recognition that the decline and fall of industrial civilization is the defining fact of our time.” That was certainly the case. No time was spent on hopes that technology will magically come up with something that will let us keep our cars and energy-intensive lives. The talk was all about the post-industrial future, how to prepare for it, and how to survive in the new spartan world to come.

I am going to give my account of the talks I was able to attend in a different order than they were given. The reason is that the subject is for most people an extreme one: contemplating the breakdown of our society in the relatively near future. Tom Whipple and Gail Tverberg concentrated on the immediate problems we face in fossil fuel depletion, the most pressing potential cause of such a collapse. Their evidence should come first. John Michael Greer and Dmitry Orlov focused on what comes next, so their comments should follow on.

(Gail Tverberg and Tom Whipple presented many statistics in their talks. I have checked these and they come almost entirely from the U.S. government official Energy Information Administration. The speakers refer to the beginning of the plateau in world oil production variously as 2004 and 2005. In fact, oil output was slightly higher in 2005 than at any point in 2004, but production fell off a year later to levels a little below the 2004 highs, giving both 2004 and 2005 defensible claims as the starting point of the long flatline that followed.)

Gail Tverberg: Rentier Debt and the Collapse of Debt Based Finance

“You can’t have infinite growth in a finite world,” Gail the Actuary began. Natural systems stay generally in balance. If there are more predators, they thin the prey population. In the next cycle some of the predators have died off and prey numbers expand, leading in the third iteration to more predators again and so on. Human societies in contrast are growth based with no effective predators except war, disease, and occasional famine.

“You can’t have infinite growth in a finite world,” Gail the Actuary began. Natural systems stay generally in balance. If there are more predators, they thin the prey population. In the next cycle some of the predators have died off and prey numbers expand, leading in the third iteration to more predators again and so on. Human societies in contrast are growth based with no effective predators except war, disease, and occasional famine.

Even when we were hunter-gatherers the small groups of humans could move to new territories and they discovered fire, tamed dogs, and invented spears. Populations increased steadily from the adoption of agriculture, then skyrocketed with the energy boost of the fossil fuel economies of coal and then oil.

“In natural systems the rule is the survival of the fittest. Human intelligence defeats this, steadily increasing the population, overcoming hostile environments.”

The modern, fossil-fuel-based industrial economy is founded on perpetual growth. “More materials are steadily needed from the natural world. These have to be transformed into usable goods. And the purchasers must have a way to pay for them. This gives rise to the rentiers, enablers of debt. Debt allows people to buy things they can’t pay for. This works for the federal government as well as for individuals. In 1945 at the end of an expensive war U.S. debt amounted to half, .5, of GDP. In 2008 it had grown to 2.8 times GDP. World per capita energy consumption also shot up after World War II. And better health care led to lower infant mortality and longer lives, so population shot up faster.”

The current world financial system is based on debt. “Banks loan principal. Borrowers pay back the principal plus interest. You need growth to make those payments. The number one problem of the rentier system is that it is easy to repay loans in an expanding economy, but hard in a declining economy. When oil prices rise, discretionary spending slows. There are layoffs. People can’t pay their debts, and don’t owe as much in taxes so the government’s income declines.”

There is a risk of general collapse in a prolonged economic decline. “For one thing, the FDIC has only a fraction of the amount needed to fund a general run on the banks, and the major pension funds are mostly in deficit and vulnerable to any significant downturn in the stock market. The government today is paying out $1.46 for every $1 it takes in in taxes.”

One person asked if a steady-state economy without growth would be an alternative to capitalist and socialist dependence on economic growth. Tverberg replied, “The population is too high for that. There are not real alternative energy sources for steady-state. Deforestation was a problem 4000 years ago. Erosion is a big issue around the world, responsible for many society collapses. Without plentiful and cheap oil there could only be a steady-state economy at a very low level. And there isn’t enough land for everyone to have their own plot.”

And finally, very bluntly:

“You need to get to a small enough community to gather around a general store and run a barter tab, where you bring in your stuff to get something from the store.”

Gail Tverberg on Resource Depletion in General and Fossil Fuels in Particular

Tverberg began this talk with several slides, the first showing world energy use since 1820. Beginning at perhaps 10 exajoules, the total reached 100 only in 1950, then soared to about 540 in 2010. In the total mix, oil is the largest component, followed by coal, natural gas, and, at about 30 exajoules, biofuels, including wood. Nuclear and hydroelectric contribute an insignificant amount. The United States uses about 94 exajoules of energy per year. Per capita oil consumption has been declining since the price began to escalate in 1980, while natural gas, which has been widely substituted for oil in producing electricity, along with coal, has been rising rapidly.

Conventional oil, that is, ordinary crude pumped out of onshore wells, peaked in 2004 worldwide and has plateaued since then. There is other oil or oil-like substances available and included in claims of total reserves, but we must understand that these are both much more expensive and far slower to extract. In successive layers, Tverberg said, there is shallow-water liquid oil, onshore heavy oil (Venezuela), tar sands (Canada), ultradeep-water oil, polar oil, shale oil (fracked in North Dakota and other locations) and oil shale (kerogen, mainly in Utah, not currently in commercial production).

“The situation is similar for all minerals. Companies extract the best and cheapest resources first. It always looks like there is plenty left, and there is, if your standards are low enough. What is left is lower quality, usually produces less energy per volume, costs much more to extract, is slower to extract, and often requires inputs, such as massive amounts of water, that must compete with other necessary uses. The bottom line is that companies will not spend more than one barrel of oil to recover one barrel of oil. At that breakeven point no matter how much is left in the ground it will stay there.”

For most minerals, companies dig them out only as they are needed. Oil is different. The need is so great that it is drilled as fast as technology permits, and everywhere it can be found if the price is high enough. According to the government’s Energy Information Administration, U.S. oil production peaked in 1970 at 9.6 million barrels a day. It declined until about 2008 at about 4.95 mbd. The turn to unconventional and expensive sources has pushed output up to 5.67 mbd in 2011.

European production plateaued around 1996 at around 7.2 mbd, then went into sharp decline from 2002. By 2010 output had fallen to around 4.5 mbd. World oil production rose for a long time, from around 30 mbd in 1965 to 80 mbd in 2003 but has flatlined at between 80 and 82 mbd since 2004. Production has proven to be inelastic. It hasn’t responded to wide price fluctuations, contrary to the predictions of the standard economic model. The $147 a barrel price spike in the spring of 2008 didn’t bring any more oil to market. The collapse to $40 later that year as the recession hit did not produce a drop in production. The new rise to over $120 a barrel early in 2011 also failed to elicit an increase. This means that producers are pumping as fast as they can and this is the supply available.

“The question gets to be: How high a price can the economy afford? High prices for oil lead to high prices for food as well. The two prices graph as a tight parallel. As prices of oil, gasoline, and food go up, people cut back on discretionary spending. Workers in discretionary sectors are laid off. Recession arrives or lingers.”

Natural gas consumption has been fairly flat, Tverberg said. “The prices have seen a big slide. There is overproduction just now. Shale gas costs $6-$7 a thousand cubic feet to produce and is selling for a little over $2. This contrasts with oil, where the global production cost worldwide is around $92 a barrel.”

Eventually there will be a peak in coal production as well as the two other fossil fuels, but we are not there yet. “World output has been growing rapidly, from about 2 billion tons in 1980 to more than 3.5 billion tons in 2010, mainly to fuel the growth of manufacturing in China and the rest of Asia.”

In summary Tverberg said that world oil production is flat, while demand keeps increasing, meaning rising prices, which induce recessions. “U.S. production is up a little, but not enough to fix the world’s problem.” Natural gas is produced and traded in national markets or where contiguous land mass allows delivery by pipeline, so prices vary widely by region. “U.S. production is up but demand is not, so prices are too low. We should expect production to drop. Coal production is up worldwide, mainly for use in Asia.

Tom Whipple: the Myth of Energy Independence

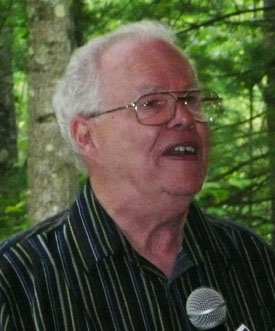

Tom Whipple, white haired, genial, and closer to my age than the other speakers, also came with a PowerPoint slide show. This time I wised up and snapped photos of his slides as an aid in following the rush of graphs and numbers. He opened with some general observations on why, even with the current heavy investment in tar sands and shale oil, the United States is not going to become independent of the stagnant world oil market.

Tom Whipple, white haired, genial, and closer to my age than the other speakers, also came with a PowerPoint slide show. This time I wised up and snapped photos of his slides as an aid in following the rush of graphs and numbers. He opened with some general observations on why, even with the current heavy investment in tar sands and shale oil, the United States is not going to become independent of the stagnant world oil market.

“Peak oil is not a theory,” he said. “It is a number. Kjell Aleklett, professor of Physics at Uppsala University, Sweden, and president of the Association for the Study of Peak Oil and Gas (ASPO), has a new book just coming out, Peeking at Peak Oil , that pulls together some of the key numbers. The most important is that conventional oil, what we call crude oil, plateaued in 2004 at 82 million barrels a day. Conventional oil rests on a column of water, which is what makes it easy to extract, compared to oil saturating rock or sand. This key source is declining by 4-6%, or 4 mbd each year. It is supplemented in the world’s supply by unconventional oil. These are tar sands, shale oil, Venezuelan heavy oil, and deep sea oil. U.S. Energy Information Administration experts project that these sources combined can only increase to an annual 8 mbd over the next twenty-five years. In the same period conventional will have declined by 100 mbd, more than today’s total annual output. If there is to be any conventional oil at all in 2037 it would depend on a very high rate of new discoveries, and we are not seeing that.”

A slide now showed that in the United States the use of fossil fuels actually increased from 70% of energy use in 1975 to 80% in 2011, with renewables supplying only 9.1% in 2011 and nuclear 8.3%. The U.S. consumed 18.8 mbd in 2009, of which it produced 7.5 mbd. (These figures, from the Energy Information Administration, include natural gas liquids and oil condensates such as propane and naptha; 5.36 mbd of this total was crude oil).

“There has been a great deal of hype in the media over the increase in U.S. oil from Canadian tar sands and the Bakken Shale in Montana and North Dakota, but the amounts are not a significant part of U.S. consumption, not remotely enough to free the country from the need for imported oil. Total oil production in the U.S. from all sources, including the new unconventional ones, rose from 7.5 mbd in 2010 to a rate of 8.2 mbd in the first quarter of 2012, an increase of about 700,000 barrels a day out of a total consumption of more than 18 million barrels. Not a game changer.

“The problem with unconventional oil is not only that the production rates are low compared to our consumption, but the costs are extremely high for deep water platforms, tight oil (fracked shale oil), and tar sands. A deep water platform costs up to $1 billion. The returns have been disappointing compared to that cost. The Atlantis Platform, the third largest oil field in the Gulf of Mexico, was supposed to be rated at 200,000 barrels a day. It hit a little over 100,000 in the first half of 2008, fell to 20,000 that fall, peaked at a little under 140,000 in January 2010, and went into a slide after that, reaching 60,000 barrels a day in April 2011. The Atlantis field is claimed to sit on 600 million barrels of oil. The media frequently report discoveries of fields with 100 million barrels as though this will solve our energy problems. The oil companies won’t drill for 100 million barrels in deep water. The costs are prohibitive.”

Here he showed some slides of total current and projected U.S. oil production. It had been in a steep slide from a high of 9.6 mbd in 1970 to about 4.95 in 2008. Alaskan production is in a downward slide expected to continue without improvement through 2035. There was a slight upturn after 2008 in U.S. onshore production from shale oil, and a sharper one in offshore, but the total production still did not reach more than 5.7 mbd (now we are talking about crude oil only), and it is projected to plateau at 6 mbd all the way through 2035. Because of the lingering recession current consumption has fallen to 14.6 mbd, the gap of 8.9 mbd made up by imports.

“The much ballyhooed shale oil has produced only 860,000 barrels a day since 2008, 6.5% of total consumption, and these plays have a huge decline rate, as much as 35% a year. It costs $10 million to drill a shale well. It is 5,000 feet down, then maybe a mile more horizontal. It is not clear that the oil companies will see this experiment as a real paying proposition when the well will be exhausted in as little as three years.

“Then there is the hype about the kerogen in Utah. There are supposed to be 1.7 trillion barrels of the stuff. Kerogen is a mixture of various organic materials a few million years short of being cooked into oil. The problem is that nobody knows how to make it usable in any potentially commercial way. The stuff in the Bakken Shale in North Dakota is actually oil. The stuff called oil shale in Utah is not. It is a solid. It has to be heated to release a vapor that is to be turned into a liquid fuel, with a high grade field producing only 25 or 30 gallons per ton of rock, and a fuel that is not suitable for gasoline, only diesel and jet fuel, with a vast input of water to process. So far there is no commercial production from this source.”

The Bakken Shale mostly demonstrates the inability of this source to meet a significant part of U.S. energy needs. “The are more than 3,500 producing wells in the Bakken Shale in North Dakota. But the average well, which costs $11.5 million to drill, is producing only 114 barrels of oil per day. The total output of these thousands of wells is about 479,000 barrels a day. And the wells in the Bakken are seeing a 38% decline rate. Just to keep the rather small 479,000 flowing the oil companies have to find 182,000 new barrels a day each year. This would need 1,488 new wells every year at a cost of $17 billion. In the last year only 1,130 wells were added, a shortfall of 25%, just to stay even with the board. Even with very high prices shale oil is not likely to exceed 2 mbd. It will not make America oil independent. We will have to consume much less to do that.”

Here Whipple turned to the availability of imported oil. “The press has made a misleading issue of the fact that the U.S. exports oil products. This is mainly refined gasoline, as our refining capacity is currently greater than domestic consumption. In January 2012 the U.S. imported 10.9 mbd of crude oil. It re-exported 2.8 mbd in oil products. That left net imports at 8.1 mbd. It is not optimistic that this volume will be available indefinitely. In 2002 global net exports of the top 33 exporters was 39.1 mbd. This grew to 45.5 mbd in 2005. At that rate of growth it should have grown to 58.2 mbd in 2010, but instead it declined to 42.6 mbd. In part this is a decline in supply, in part the exporting countries are using more of their oil at home. The top 5 exporters were running at 15 mbd in 1990. This rose to 24 mbd in 2004, 53% of the global total, but is dropping to 21 mbd in 2012, and is projected to fall to zero by 2028.

“Then we have to factor in growing demand. If we extend the 2005 to 2010 rate of increase out to 2020, including China and India, and allow for only a 1% annual decline in exports by the top 33 exporting countries, the countries other than China and India would see a 60% decline in available supplies, from 40 mbd to only 16 mbd.”

Natural gas displays a different trajectory from oil. At first glance it seems to promise a way out from the declining availability and increasing price of oil and gasoline. Natural gas is currently abundant and remarkably cheap. “Right now natural gas is being overproduced and is in a glut, selling below its production cost,” Tom Whipple said. “In the U.S. it is around $2.25 per thousand cubic feet at the wellhead. In Japan the price is $20. Unlike oil, natural gas is difficult and expensive to transport except by pipeline, so national prices diverge sharply.”

U.S. natural gas production has seen a big increase from fracking shale, the same process used to extract oil in North Dakota. Tom Whipple took as his example the Haynesville Shale, a 9,000 square mile deposit under large parts of southwestern Arkansas, northwest Louisiana, and East Texas. The natural gas bearing shale is a seam 200 to 300 feet thick found at a depth of 10,500 to 13,000 feet below the surface.

“This one deposit accounts for 11% of the total U.S. supply. The decline rate is astronomical, at best about 53% a year, or 3.8 billion cubic feet of gas that needs to be replaced annually. It is more likely that the decline rate per well is as much as 100% per year. There are already significant announcements of cancelations in plans for dry-gas drilling. At this time the natural gas companies are losing money. Most analysts forecast that natural gas will be abundant and cheap for decades. This is prompting investment in liquefied natural gas. Cars can run on either compressed or liquefied, but liquefied provides 600 times the energy of compressed. As a consequence, liquefied natural gas installations are going in across the country. My own view is that there is about a twenty-year supply of natural gas once the price goes up to make production profitable, especially if it is used more widely to fuel vehicles.”

He added that he expected that “by 2020 about 40% of the world’s oil supply will come from deep water wells,” and that China will probably be able to outbid the United States for the available supply, mainly because their economy is smaller and a similar amount of oil would play a larger part in their operation and would be worth more than in an economy with such already extensive uses as the United States.

Tom Whipple gave a second talk Sunday morning, on the seven forces defining the twenty-first century. This, I thought, was thin compared to his presentation on oil and gas. He did draw some conclusions, however. Fossil fuels, he said, are going away. “Politicians compete,” he said, “on claims of how much growth they can foster. But the price of oil permeates everything. It’s going to be very hard to get the economy going again as the price of oil keeps going up. There will be some fossil fuels available for 1,000 years. It may be allocated by price. But there will not be sufficient oil to run cars.” He added that the emerging scarcities include water and most other minerals as well as oil.

* * *

On the second day, I was sitting at a stone table outside when Tom Whipple sat down next to me. I started to quiz him about oil prices. West Texas Intermediate, the main U.S. price, had fallen from about $110 a barrel in January to $90 on the day we were meeting, while the European Brent price had gone from $125 early in the year to $107 (they have fallen further since, to WTI $81 and Brent $98). Whipple responded that prices had been inflated in 2011 because of disruptions in Libya, and in the spring of 2012 over Iran’s threats to close the Straits of Hormuz. Now they were dropping, first to normal, and then somewhat below as the economic crisis in Europe feeds expectations of lower demand. There was also the unusual spread between WTI and Brent prices, which for years had varied by only a dollar or so. This, as I knew, was caused by storage bottlenecks in the main U.S. facility, in Cushing, Oklahoma, where Canadian tar sand oil is piling up, causing especially low prices for gasoline in the Midwest.

Whipple added, “There is a pipeline running from Cushing to the Gulf Coast, the Seaway pipeline. It is set to pump north to Cushing. To relieve the glut the pumps are being reversed. Even then they are too small to handle the volume. By a year from now they plan to install larger pumps, at which time WTI and Brent prices should reconverge and gas prices go up in the Midwest. There are other markets besides WTI and Brent. The Canadian market is going now for $72 a barrel because they can’t get their product to market.

“The long-term picture is much less optimistic,” he said. “World demand is going up on an annual rate by 1 million barrels a day, while the decline in production in existing wells is running at 4. That means that new discoveries need to hit the equivalent of 4 million barrels a day just to stay even and 5 to keep up with demand. I don’t see that happening, and that means that prices will start to go up again unless the recession gets a whole lot worse.”

John Michael Greer on Spirituality for an Age of Limits

John Michael Greer in person is charming, charismatic, and quick witted. A big burly man of fifty with a full beard, he appeared in casual clothes. Seeing him first at the opening dinner on Friday night it had taken me a moment to recognize him, as in most of his internet photos he is wearing a long white robe. That is because, in addition to his books and blogging on resource depletion and our de-industrialized future, he is also the leader of the Ancient Order of Druids in America. He has written twenty-one books, only three of which are about resource depletion. The rest explore polytheism, Renaissance magic, Kabbalah, divination, the other such topics. He was trained in the ritual magic of the Hermetic Order of the Golden Dawn, the occult lodge made famous in the last century by William Butler Yeats and Aleister Crowley. His sessions were the best attended in the heavy agenda of the three-day conference.

John Michael Greer in person is charming, charismatic, and quick witted. A big burly man of fifty with a full beard, he appeared in casual clothes. Seeing him first at the opening dinner on Friday night it had taken me a moment to recognize him, as in most of his internet photos he is wearing a long white robe. That is because, in addition to his books and blogging on resource depletion and our de-industrialized future, he is also the leader of the Ancient Order of Druids in America. He has written twenty-one books, only three of which are about resource depletion. The rest explore polytheism, Renaissance magic, Kabbalah, divination, the other such topics. He was trained in the ritual magic of the Hermetic Order of the Golden Dawn, the occult lodge made famous in the last century by William Butler Yeats and Aleister Crowley. His sessions were the best attended in the heavy agenda of the three-day conference.

Saturday opened with Greer speaking on spirituality. He started before the assigned time, relaxed, speaking fluently without notes, offering advice for life in a post-oil landscape:

“You don’t need to move out into the country,” he told people. “Adapt in place. Deal!” He quoted wildlife author and scouting pioneer Ernest Thompson Seton, “Where you are, with what you have, right now.” Greer was born in Bremerton, Washington, and lived for a long time in Ashland, Oregon. He moved a few years ago to Cumberland, Maryland, a few miles down the road from the Four Quarters InterFaith Sanctuary. The town had 37,000 people in 1950 and just 20,000 today. Greer said he picked it because it had already gone through de-industrialization and was close to farming areas.

“Brew beer,” Greer advised. It could always be traded for something in a barter economy. “Japan in 1750 had almost no energy,” he said. “Yet the Tokugawa period saw a great flowering of culture and the arts. It was based on rice and human labor. You have to build the skills that will be needed as energy winds down. Barter with your neighbors. There are a certain small number of places, like Manhattan, where the only option will be to get out. Even when the Greenland ice cap melts, Manhattan will still be a source of metal.” He added Boston and Los Angeles to the list of unsalvageable megalopolises.

“Ten thousand years from now there will be legends about the lost cities of the desert – Las Vegas. If you are unlikely to have your own water supply, get out. Much of the suburbs used to be chicken farms, dairy farms. As the cities downsize, the suburbs can revert to what they were. Stop worrying about death. Take a risk. There is a 100 percent risk of death.”

By this time the last of the audience had filtered onto the open sided roofed platform and Greer began the scheduled address.

“When people want to know about spirituality and peak oil, they usually want to hear of some supernatural force that is going to make it safe. ‘Why aren’t you talking about the space brothers, who are going to bring a new energy source?’ Another refrain is the fantasy of the Rapture. Saint Scottie is going to beam them up to the S.S. Christ Enterprise. It’s the same as the UFO fantasy except that Jesus is at the controls of the space ship.”

Greer added futurist and computer guru Ray Kurtzweil, who has predicted exponential growth in computing power and in technical innovation that will solve the energy problem along with many others. “Greer’s first law of exponential functions: Any exponential function taken far enough ends in absurdity. Kurtzweil predicts that we will upload our minds into robot bodies and achieve immortality. These are just glorified Rapture bodies.

“There are whole industries focused on telling us that we don’t have to have the future that we have made. We can’t fix it. We could have fixed it in the 1970s and we didn’t. We need to stop thinking that marching around blaming the 1% will fix it. If you make $34,000 a year you are part of the global 1%.”

Greer sought to distill a common element in the world’s major religious traditions. “They deal with the relation between humans and gods. Gods signify that there is an order to the cosmos and it is not subject to your druthers. Every now and then the humans are off building utopia. The gods go away for a while, and return to find a smoking ruin. They ask, how is that utopia working out for you?

“Humans are pretty good at building civilizations. All start with some sense of the order of the cosmos. Over time the civilization becomes rich, lazy, and from there to the smoking rubble is not a great distance. There is a concept of order in many schools of thought: in Hinduism, in Buddhism, in the Chinese Dao. Our fossil fuel utopia ignores every scrap of the concept of order. Pride commeth before a what?

“Peak oil is not something that is going to happen in the distant future. It is happening now. Oil plateaued in 2005. Now we are scraping the bottom of the barrel for any scrap that can run a car.”

Back in the 1970s, he said, after the Arab oil embargo, “There were ideas of doing more with less and establishing an ecologically stable society. Then it wilted and people dropped it. We saw the way the human ego works. It was not a satanic laugh but a whiny weaseling thing where most people decided to make more money and ignore the future. We live in the shadow of an immense moral failure. The U.S. was the leader in green technology. It could have been done. We didn’t. And we will all pay the price. The universe doesn’t care if it looks fair to us.

“Spiritual traditions say that the pursuit of making money is not necessarily a good thing. I want to talk about the spirituality, the holiness, of limits. You cannot not have limits. Industrial society has tried to free itself of all limits. The spiritual place is the place of limits. Social collapse is followed by spiritual focus. Today’s Republican platform has a surprising number of parallels to the Satanic Bible of Anton Szandor LaVey, not to the New Testament.”

In the question period he was asked how he explained the Religious Right. “Religions with high ethical standards,” he replied, “morph into their opposites because of the difficulty of living the doctrine. Today salvation is a consumer product. This is not Christian except in a purely nominal sense. The Fundamentalists in the early twentieth century formed an alliance with the Ku Klux Klan. In 1924 the Rev. E. F. Stanton published a book entitled Christ and Other Klansmen . Christianity was mostly a liberal force in the 1960s, but the Devil worshippers who call themselves Christians today have given Christianity a bad name.”

Still, when someone, most likely a Marxist, in the audience, asked if Greer thought religion was merely invented by rulers to pacify their subjects, the Druid leader responded, “Religion is born not because someone made it up for crowd control, but because people ran smack into the brick wall of transcendent experience.”

Asked to predict the pace of social collapse, Greer compared it to the decline of Rome and suggested from 100 to 300 years overall. Long before we are far into that process, he said, our retirement funds will be worthless.

John Michael Greer on How Civilizations Fall

We reconvened in the afternoon for another session with John Michael Greer. “It is common for empires to claim they are eternal just before they collapse,” he began. “Rome, Byzantium, Russia, which called itself the Third Rome. Civilizations have a recognizable life cycle. Joseph Tainter, in his The Collapse of Complex Societies , pointed to a buildup of layers of complexity. His list took from 100 to 300 years to fall, not a few decades. In 2005 I wrote an article, ‘How Civilizations Fall: A Theory of Catabolic Collapse.’ There I argued that there is a fixation on overnight collapse, taken from Christian mythology. This is the idea of the apocalypse – when evil reaches its peak, God will smash the crap out of it. Just think of Harold Camping.

“Our society thinks in straight lines – to the apocalypse, then everything will be rebuilt perfectly, and last forever. We don’t look like we will dodge collapse, but it is likely to last one to three centuries, slipping down a notch, stabilizing for a while, then down another notch. The apocalyptic model competes with the progress model, where we keep getting better and better forever.”

He then turned to America’s connections with the broader world. “We don’t like calling ourselves an empire. We are just exporting democracy, to countries that have either oil or drugs. The empire requires that we maintain our stuff. People are very reluctant to give up our stuff. But maintenance costs are unaffordable. Our money system requires immense maintenance. Imperialist extraction of resources becomes very expensive. As pieces fall off, your costs go down. When we strip New York City to the ground we will have a lot of cheap metal. In decline you can cannibalize your infrastructure.”

Greer suggested that the history of other empires showed that three deep crises were typical in ending a civilization. “People respond, We are different. We have science and democracy, etc. This pattern has worked equally to end large and small civilizations. You are living in the civilization with the highest energy level and probably the highest population the world will ever see. The second Mayan crisis wiped out 90 percent of the population. But some Mayan cities continued for two hundred years. We probably will go through a dark age within the 100 to 300 years ahead. We are in the early stages now.

“The British Empire owned a quarter of the entire world. The American empire is really pretty limp in comparison. This was in a world in the first stage of catabolic collapse. We are heading into the second round of world catabolic collapse. The broad trends don’t dictate the features of the unfolding crises, but the first round unfolded between 1914 and 1954.” He dated the beginning of the first stage of the crisis for the United States from 1974-75 with the first oil shock and the American defeat in Vietnam.

So what should people do? “All the people talking about survival lifeboats or ecofarms who don’t really take up farming make the advocates feel like they are doing something, while not doing anything. Think about it this way. What can you do now that would have helped you if you were living in Poland at the outbreak of World War II? Start from the assumption that what will happen to us will be fairly similar to what happened when earlier civilizations collapsed. It could come quickly. If the money value collapsed, many people’s savings and pensions would disappear. I think of it as a stair-step model where periods of stability are punctuated by sudden lurches to lower levels.”

He did not see protest as very effective:

“There are limits to what protest can accomplish. Most Occupy protestors would settle if they got a good middle class job. But those jobs are gone forever. People are clinging to the fantasy of endless progress and infinite wealth. Most of the jobs a hundred years from now are going to be as small farmers. There’s a lot of expectations of entitlement, of feeling we deserve our high standard of living. No, we don’t, and it won’t be there. I know this is wildly unpopular, but I don’t think so. Better to prepare for the world to come, not stake on getting concessions from the existing government and the rich. As the collapse progresses the remaining fossil fuel technology will be protected by the military. None of us may see a drop of fossil fuel. I would expect an economy I call scarcity industrialism, very militaristic, top down.

“All of us are going to be poor. Most of us will die sooner than we otherwise would. But there would be the exhilaration of taking on the challenge of trying to navigate through the end of a civilization and working to found a new, if poorer, one.”

Dmitry Orlov: Progressing Towards Collapse

I had read less of Dmitry Orlov’s work than of the previous speakers. He was born in Leningrad in 1962, making him, at fifty, the same age as John Michael Greer. His family emigrated to the United States when he was twelve. He holds a degree in computer science and has been trained as an engineer. He spent extended time back in the Soviet Union just prior to and after the breakdown of Communism in 1990, and has written extensively on parallels he perceives between the sudden Russian implosion and similar trends in the United States. Having experienced the very sudden collapse in the USSR, Orlov more than any of the other speakers was ready to put a very short lead time on the demise of the American system.

I had read less of Dmitry Orlov’s work than of the previous speakers. He was born in Leningrad in 1962, making him, at fifty, the same age as John Michael Greer. His family emigrated to the United States when he was twelve. He holds a degree in computer science and has been trained as an engineer. He spent extended time back in the Soviet Union just prior to and after the breakdown of Communism in 1990, and has written extensively on parallels he perceives between the sudden Russian implosion and similar trends in the United States. Having experienced the very sudden collapse in the USSR, Orlov more than any of the other speakers was ready to put a very short lead time on the demise of the American system.

“I have been predicting that America would collapse for some time,” he opened. “What’s holding it up is a really good question. You can’t predict when exactly it will collapse, but you can track the rate of deterioration. If you drive over a structurally deficient bridge you are gambling with your life, but it’s not a game. Risk can only be assessed with accuracy in an artificial setup, like a game. The one rule is that you should never risk what you can’t afford to lose. Though not predictable, the timing of great events is not random.”

All empires eventually collapse, he said. “The timing is more difficult to anticipate. Some sciences have real experts – physics, medicine. Economics is a pseudoscience. Nobody could predict the Soviet collapse or know now why it happened that year. I saw it coming a year beforehand.”

Orlov pointed to ever growing debt as a major factor in undermining the American system. “The U.S. borrows about $100 billion a month in new debt. There has been a lot of activity lately about China. Hilary Clinton and Geithner went to China. The news was about the blind Chinese activist. The Chinese had little reaction to his escape. What was the smoke screen hiding? Reuters revealed on May 21 that the U.S. government set up a secret deal with China a year ago to allow China to buy U.S. Treasury bonds directly from the Treasury, the only government in the world allowed to do that. Everyone else goes through brokerage houses. China has also now been approved to be allowed to buy U.S. banks. The U.S. is on the road to becoming a fully owned subsidiary of China. This is very different from the historical pattern.”

He pointed to Facebook millionaire Eduardo Saverin leaving the country and taking his money with him, saying Saverin was not alone. “That happened in the last days of the Soviet Union. J.P. Morgan just lost $2 billion. It seems they can’t understand the difference between hedging, betting, and gambling. No one goes to jail for any of this.”

On the political front, “The government has been taking away rights. Congress is in process of passing a bill that would allow the IRS to take away people’s passports if they owe a large amount of taxes, turning the country into a debt prison. The politicians make sure none of their banker friends go to jail, as they would lose their subsidies. I saw this in the USSR, as the political system was hollowed out for private interest.”

As the collapse got underway in the USSR, trade reverted to barter. “In 1990 people were refusing to take money. They wanted real goods. People with money were leaving. In the USA the idea is to print money and buy oil and consumer goods with it. Very little is still made here. The assumption is that transportation costs don’t matter. But they are not negligible. They are like a large hidden tax on everyone’s income.”

Orlov said we should expect an oil crisis, followed by a new economic downturn, “a stair-step downward.” A major risk factor has been the growth of unproductive sectors of the economy, including its bureaucratic/administrative portion, which he estimated at about 30 percent. Very high debt and a weak productive sector, he said, amplify the effects of high oil prices and create a different and more dangerous curve than the curve of peak oil itself. “Peak oil is a bell shaped curve. The curve for economic collapse is lopsided, broad rise, sharp drop off. It is shaped by a number of progressions: the move of industry to China. Most spare parts come from China today. Small shops have been replaced by Wal-Mart. They open a store, sell Chinese goods, local stores go out of business. Then Wal-Mart leaves. Today they are more interested in opening stores in China. The pattern is that things get bigger, then things go away.

“We used to have lots of small ships. Now we have mega-container ships. Because of rising fuel prices they have to slow down to save fuel, running at 10 knots, slower than Clipper ships. Slow steaming will be followed by no steaming.

“Internet retail only works because of UPS and Fed Ex. When the big medical complexes fold we will have Web MD.”

The U.S. is showing many symptoms of decline. “It has some of the most expensive cell phones in the world. But Internet speeds are slower than most of Europe and Asia. Cell phones are used for internet in rural areas. This is like Vietnam and Cambodia. The electric grid is aging and not kept in good repair. The transformers are not made in the United States. We are seeing more frequent blackouts. The nuclear plants are not being maintained. Bridges are not being maintained. The incidence of power outages has been doubling every year (according to a report by Goldman-Sachs). Countries without a reliable electric grid rely on gasoline or diesel generators. One example is Nigeria. It is now common for diesel generators to be used for local city electric power.”

Two-thirds of the oil the U.S. uses, he said, is imported on credit.

Next he turned to our food supply. “A vast part of our food supply depends on Monsanto corn. It is used to feed livestock, and for the corn syrup that shows up in so many food products. There are only a few very similar varieties of corn, which are at risk of a poison-resistant pest. This could be like the Irish potato famine, where people are too dependant on a single crop. We even have exploding pigs.”

This last refers to the appearance over the last few years of a mysterious foam at one in every four pig farms. The gelatinous foam seals in volatile methane gas in manure dumps on the farms. Four explosions have taken place killing thousands of pigs. “Most people are not paying attention,” Orlov added.

Dmitry Orlov expects the crash to come very soon. Not in decades, and probably not even in years, but possibly in months. He offered some advice, based on his Soviet experience.

“We have far too much disposable trash. Mend, don’t buy. Don’t let fashion dictate technology. Strive for fewer possessions but better quality. Get another passport. Rely on local groups. Avoid debt slavery. People may be forced to make payments against debts that will go on to the end of their lives. You don’t know if institutions will remain solvent. Your savings may become just some gold and silver coins for special occasions. Retirement will go away. Everyone will have to work as long as they are physically able to do so.

“It is better to give something away than to throw it away. People will stay close to home. Do household production to minimize the need for money. Wealth will be other people you can rely on. Mexicans have decamped to their own country, thinking it has a better chance than here.”

In the question period Orlov was asked if he anticipated civil wars between neighboring states. “Not by state militias,” he responded. “But law and order in some of the cities will be impossible. Expect tribal gangs and communal violence.”

Asked if the pending collapse was a plot by the government, the rich, or the oil companies, he replied, “I try not to think there are conspiracies where mere stupidity will explain it.”

At the end of the conference I picked up a copy of Dmitry Orlov’s book, the revised edition of Reinventing Collapse: The Soviet Experience and American Prospects . He makes a convincing argument that the USSR and the USA mark the extremes of collectivism and of free market among the major powers, and that these ideological extremes make their systems more brittle than the states that have adopted a more balanced mixture of state and private institutions. It may come as a surprise in light of the Soviet Union’s well known police state and impoverished citizenry that their system gave their citizens a far better chance to weather the collapse than the American system does. In the USSR no one owned their own home. Everyone lived in government owned apartments. When the collapse came there was hyperinflation, wiping out savings, and very large numbers lost their jobs and had no income. But no one lost their homes. They just kept on living in their shabby apartments rent free. In the United States, as the 2008 recession previewed, loss of job, pension, or income means eviction and homelessness. There were very few homeless in post-collapse Russia, mostly ethnic Russians expelled from the breakaway Soviet client states.

Further, for many reasons the Soviet planners did not like urban sprawl. Services were too expensive to provide, they did not want so many automobiles, for both cost and security reasons. The result was that most urbanites lived in closely packed apartment houses served by extensive mass transit. The trains and trolley cars kept running all through the worst period of the downturn. If oil and gasoline prices go through the roof here, and people lose their jobs, suburbanites and most city dwellers are going to simply be stranded. Unless the government remains more intact than seems likely we will see many more deaths from malnutrition or outright starvation here than in Russia.