The Hunger Ahead

Leslie Evans

The Coming Famine: The Global Food Crisis and What We Can Do to Avoid It . Julian Cribb. Berkeley: University of California Press, 2010. 248 pp.

The Race for What’s Left: The Global Scramble for the World’s Last Resources. Michael T. Klare. New York: Henry Holt and Company, 2012. 306 pp.

Back in 1798, Thomas Malthus published his Essay on the Principle of Population . He put forth the simple proposition that, land being finite, the food supply increases only arithmetically, by small percentages, while humans have multiple births that in the next generation have multiple births so that population increases geometrically and will periodically locally, and in the end globally, outrun the food supply. The premise would seem irrefutable, though the date when the ultimate bill comes due is uncertain. On the right, Malthus was rejected on the ground that God would take care of his own. On the left, for two centuries Malthus was dismissed with the argument that there would always be sufficient food if distribution were more equal. We are now in the endgame.

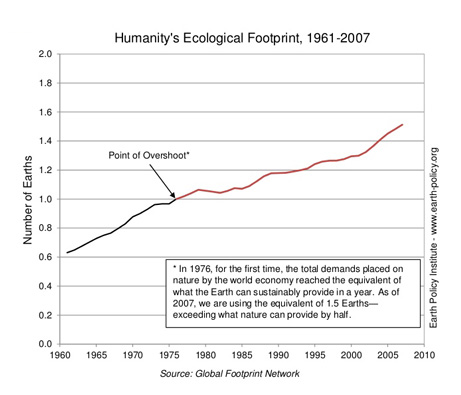

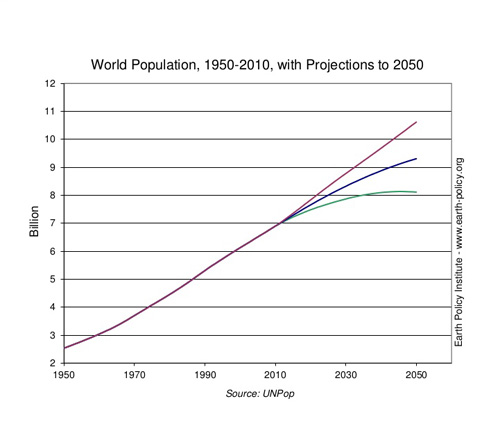

On one side of the ledger we have a human population that has just topped seven billion, headed for nine billion by 2050, with large sections of the underdeveloped world rapidly raising their standard of living. On the other we are now hitting the planet’s limits of arable land, potable water, mineral nutrients required for agriculture, and severe depletion of sea life by global over-fishing. All of this while global warming lights a fire under the whole kettle, most immediately reducing the snowfall and mountain ice caps that feed the world’s great river systems on which a large part of world farming depend, and temperatures rise, producing historic droughts. As the days of cheap oil have departed the crisis is exacerbated as food crops are diverted to make biofuels.

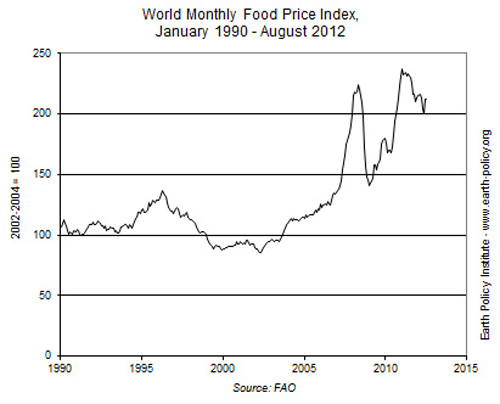

Julian Cribb provides an excellent summary of what we are up against, along with many proposals that might improve our situation if governments were to act on them. Harvey Clare brings the survey two years ahead to where we are now, and offers a broader canvas on our limits, including oil and minerals. Since 2004 global food prices have more than doubled. Like oil, with which food prices run in close tandem, this has been an ascending roller coaster, with sharp rises followed by steep falls, but with the overall trajectory upward. The UN Food and Agriculture Organization’s World Food Price Index stood at 100 in 2004. It hit some 240 in 2008 along with the spike in oil prices to $147 a barrel, touching off food riots in a dozen countries and sparking the Arab Spring, especially in Egypt. But when prices fell in 2009 they did not get below an index of 148, almost a 50% increase over 2004. The index has been above 200 since 2010 and is currently rising from there.

In America, where food is still a small part of the budget of the employed, despite the millions on food stamps, the effects of this shockwave are still little felt. In the third world, fifteen thousand children die each day of hunger-related disease.

World hunger was abated in the 1970s by the Green Revolution of more productive and pest resistant grains. That improvement has run its course, while population has continued to explode. Cribb reports that by 2009 a billion people were eating less than the year before.

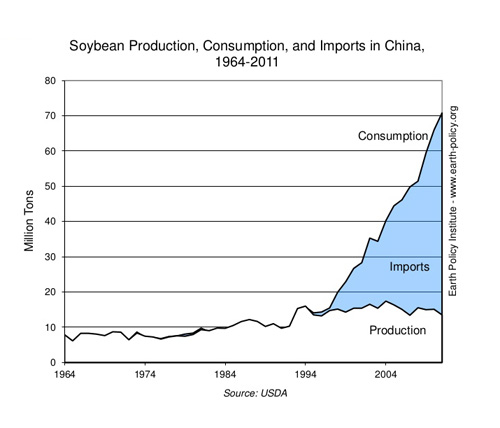

Many currents are converging on the impending world famine. The rise in oil prices has compelled Thai rice famers to park their tractors and plow with buffalo. In China increasing meat consumption by the burgeoning middle class has led to a ten-fold increase in the need for feed grain. In eastern Australia there was a ten-year drought. Cribb writes: “This challenge is more pressing even than climate change. A climate crisis may emerge over decades. A food crisis can explode within weeks – and kill within days.”

Population growth rates are declining, but not fast enough. World growth rates average at 2%, while food output is only going up by about 1%. There will be two billion more people by the time world population stablizes at mid-century. In the meantime, as living standards rise rapidly in China, India, Brazil, and other poor countries, pressure on world food supplies are heading toward a breaking point.

By 2050 total food output will have to double to meet the larger and more affluent population. This will have to be done, Cribb writes, “using far less water, less land, less energy, and less fertilizer.”

Water

Drought only exacerbates a more fundamental problem. Only 2.5% of the water on earth is fresh water, usable for farming and drinking. All of that comes from rain and snowfall. The vast majority of the water that falls from the sky quickly disappears again, from evaporation and runoff to the sea. Perhaps 10% is usable by humans. Of that, today 70% is used for agricultural irrigation, power generation takes 20%, and urban water supplies take 10%. Much of the world’s drinking water is contaminated. This kills 2-5 million people a year in poor countries.

The world’s population is rapidly urbanizing, departing rural areas for the megacities. As urbanization expands, it concretes over adjacent farmland, reducing cropping area, and the urbanized people use more water. According to Cribb, “Urban demand for water may soar by as much as 150 percent by 2025 as the cities themselves burgeon.”

The water needed to make our food varies hugely by what we eat. It take 7 gallons of water to grow a potato, 179 for a pound of grain, but 1,797 gallons for a pound of beef and 719 for a pound of chicken. As standards of living rise in developing countries there is more consumption of animal meats requiring far greater amounts of water in agriculture and stock raising.

At the same time, the total available amount of fresh water is rapidly declining. There are many causes: desertification from natural causes, climate change, or over cropping; removal of natural vegetation leading to rising saline groundwater or leaching of acidic soils into streams; concentration of toxins such as arsenic from humans pumping out ground water; and overuse of lake and river water for human uses that dry up reservoirs and even large rivers. Shockingly, Cribb reports, “In the last four decades of the twentieth century, the amount of fresh water available for each human being worldwide shrank by almost two-thirds. It is expected to be halved again by 2025.” On a planetary scale, we have hit “peak water.”

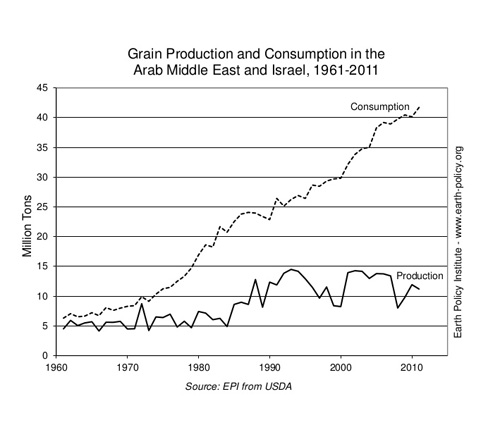

China faces one of the most serious water threats, “with 22 percent of the world’s people and just 8 percent of its available freshwater. The Chinese Ministry of Water Resources has warned of a serious crisis by 2030 due to falling per capita water availability.” The other areas facing the most serious shortages are the Indian subcontinent, the Middle East, North Africa, and parts of southern Africa. Lacking sufficient water to be self-sufficient in agriculture, these regions will have to import a large part of their food, a major drain on their economies, if world food markets are even able to provide what they need.

This is not just a problem for poor people in faraway places:

“In the United States . . . groundwater supplies more than half of all drinking water and more than one-third of all agricultural water needs. The huge Ogallala aquifer, which underlies eight states in the American Midwest and is extensively used to grow food, is being depleted at ten times the rate of natural recharge, and some experts fear it could dry up completely within twenty-five years.” The situation is even worse in the arid Southwest.

Farmland

The amount of farmland per person on our planet has been in decline for fifty years. It was 1.1 acres in the 1960s. By the 2010s it had fallen almost by half, to .6 acre. It will keep heading downward as the next 2 billion people join us in the next 35 years. The margins for possible increased planting vary significantly by region. Asia already has 75% of potential land under cultivation; the Middle East and North Africa, 87%. Latin America is only at 19%, but the land not turned to crops is largely the Argentine pampas and the Brazilian and Peruvian rain forest. Russia is in perhaps the best position, with only 44% of potential farmland under cultivation and large stretches of Siberia expected to be more amenable to agriculture as global warming advances.

Cribb tells us that Asia will have to double its food supply by 2050 but has only 25% more land to do it in. The Middle East and North Africa will need 150% more food with only 13% more land to grow it on.

But even this gloomy picture hides worse news. Most potential farmland is not in use now because it would be environmentally destructive to use it, as in Brazil, or because the soils are very poor and would need extensive fertilizer and energy to grow crops there. At the same time existing productive land is degrading faster than new lands are put in service, through erosion, exhaustion of the water tables, salinization, and loss of soil nutrients. Cribb concludes:

“[T]he arable area, which produces most of the grain, oilseeds, fruit, and vegetables we eat or feed to livestock, is growing at only one-seventh the rate of consumption and one-forty-sixth the rate of population. Thus, from 1990 to 2005, world demand for food grew fifteen times faster than the area of land available to produce it.”

A truly frightening response to this dire situation has been the purchase by arable-land-scarce nations of vast tracts of farmland in other people’s countries, mainly in sub-Saharan Africa. This trend set in after the food price shock of 2008, when it became clear that world grain markets could not supply demand. China, Saudi Arabia, the Arab emirates, and some other countries decided for their food security to buy large pieces of other countries. China bought 3 million acres in the Philippines and 1.7 million in Laos. The United Arab Emirates bought 2.2 million acres in Pakistan and 934,000 in Sudan. South Korea also bought large acreage in Sudan. Even Russia, which wouldn’t seem to need it, is buying up farmland in Africa. This neocolonial land grab has continued apace since Cribb went to press in 2010. Harvey Klare adds more on this trend and we will come to his findings later. Corrupt governments, for a one-time payment, sell off land essential to their people’s future survival, usually in the process expelling indigenous subsistence farmers who have lived there since time immemorial.

Existing farmland is degrading at a devastating rate. In 1991 a UN survey found that 15% of the planet’s land was no longer bearing vegetation. In January 2008 the FAO reported its own global satellite survey, which found that 24 percent of the world’s land was now denuded. Cribb estimates at that rate 1% of productive land is reduced to unusability each year. On the same principle as compound interest this “will ruin two-thirds of the world’s productive land by 2050.” The United States is among the world’s top five countries with the worst land degradation. The others are Russia, Canada, China, and Australia, all five key grain producers in the world economy.

Salt and acidic poisoning of farmland afflicts different regions. The Indus valley that feeds both India and Pakistan suffers heavy salinity, ruining 100,000 acres of Pakistan’s irrigated land per year. Acidity is a product of cutting down tropical forests, leaving behind land good for only a year or two of planting. There is a lot of this in Southeast Asia and still more in South America. This puts severe limits on replacing Brazil’s rainforest with farms. Arsenic poisoning is another threat, arising from pumping out too much groundwater, which concentrates naturally found arsenic as the soil dries. This is prevalent in China, the Indian subcontinent, Southeast Asia, Iran, Argentina, and the United States. Since Cribb published we have had the revelations of the high levels of arsenic in rice, with brown rice retaining seven times the amount of arsenic legally permitted in water, and the worst of this crop coming from the American South, where the natural arsenic is compounded by the residues of arsenic-based pesticides used when the land was given over in the past to cotton.

Cities and their suburbs are mostly built on prime farmland. Bedroom suburban communities and still further outlying recreational areas eat up still more land. New York occupies 4,349 square miles, while the Boston to Washington, DC, urban mega corridor has left very little room for farmland. The land further out is often of poorer quality and less productive. There is also a grave risk in this pattern. Cribb writes:

“[M]odern cities, which once supplied quite a lot of their own food, especially in the form of fresh fruit, vegetables, and poultry – notably in Asia – have largely been planned and developed in ways that expel agriculture from within the urban perimeter. This is a piece of extraordinary blindness on the part of today’s urban planners . . . which could well turn some of these giant cities into death traps in the event of serious future disruptions to food supplies.”

On the same page Cribb refers without qualifiers to “the coming famine of the midcentury.”

Expected sea level rise from global warming is another cause that will diminish the world’s arable land. Even a modest rise, of fifteen inches, at the conservative end of predictions for the end of this century, would displace thirteen million people around the Bay of Bengal and cut Bangladesh’s rice harvest by a sixth.

The Limits of Fertilizer

The Green Revolution, which staved off starvation for the last half century – while population grew from 3 billion in 1960 to 7 billion in 2012 – depended on both new, more productive, varieties of grains, and also ample supplies of fertilizer. Commercial fertilizer is also essential to agribusiness production, the largest source of food for the American consumer. Cribb goes so far as to say that fertilizer has been “the principle cause of the human population explosion.” Modern commercial fertilizer is commonly called nitrogen fertilizer after its largest ingredient. Commercial nitrogen is produced from natural gas as a feed stock, and this remains comparatively plentiful and, at least in the United States for a while, relatively cheap. Nitrogen can also be set in the soil at a smaller scale by planting legumes.

But there are three essential ingredients of functional fertilizer and the other two are more problematic: phosphorus and potassium. All three are essential. If one is missing plants are likely not to grow at all. Phosphate rock, the source of phosphorus, is the most at risk. Eighty-four percent of world phosphorous comes from only four countries: China (37 percent), Morocco and Western Sahara (32 percent), South Africa (8 percent), and the United States (7 percent). As this mineral essential to our lives becomes more scarce the price has been escalating. It sold for barely $3 a ton through the first half of the twentieth century. In 2000 it reached $44 a ton. During the oil and food spike of spring 2008 it shot up to $430 a ton. Now in late 2012 it has stabilized at about $185 a ton. Spurred by the higher price, world output, which had fallen to 120 million tons in 2009, was estimated at 186 million tons in 2010. Unlike oil, for which at least some partial substitutes are available, there is no substitute for phosphorus. “No phosphorus, no food.” It seems at least unlikely that world phosphorus output can be doubled in the next thirty-eight years to feed the population expected to be here by 2050, not to mention the shift to greater meat in the diets of developing countries, necessitating vast increases in grain for feed compared to a principally vegetarian diet. Here price as well as sheer volume is an essential determinant of potential use. Already many poor farmers have been priced out of the fertilizer market by the price spiral after 2008.

Fertilizers are heavily overused, with little or no control of the runoff, which massively pollutes waterways and the broader ocean. The waterborne fertilizer provides food for algae blooms that rob the water of oxygen and can lead to mass extinction of sea life. On land, much fertilizer, to save costs, shorts the phosphorous and potassium and leans mainly on nitrogen, with the result that whatever quantity of the two shorted minerals does exist in the soil is leached away.

Cribb ranks the nutrient crisis as of similar weight to the far better known ones of climate change, peak oil, and water scarcity.

There is leeway in the system to expand food production, though the raw statistics would seem to overstate it. Some 40 percent of all food produced in the United States is thrown away. This ranges from spoilage before it can be shipped to unsold vegetables in the markets to canned and other goods that are tossed when they reach their sell-by date, though they are actually good for some considerable time after that. It would take a major organizational effort at many levels to improve this picture.

One option for recovering both nutrients and water is to recycle city sewage and human waste, which contain large amounts of recoverable phosphorous. This would require expensive processing, along with recycling waste water for reuse.

Cribb also advocates re-greening cities. His proposal is far more extensive than backyard and community gardens. He suggests planting foodstuffs on freeway and highway sidings, flat building roofs, and front yards, and even enveloping existing buildings in fruit-bearing vines. “It is time to recognize,” he writes, “that regulations about waste disposal and urban farming, created with perfectly sound public health aims in view, threaten far more lives in the event of major food scarcities than they will save.”

He cites approvingly a proposal by Japanese civil servant Makoto Murase for large-scale saving of rainwater by installing cisterns under buildings. A related idea is to replace ordinary concrete with permeable material to direct rainwater back into the water table instead of running it out to rivers or the ocean.

The Are Not So Many

Good Fish in the Sea

“Worldwide, the evidence is mounting that the fish are running out. Almost one in three sea fisheries has collapsed or is in the process. . . . Most of the continental shelves have been swept clean and even miles down, in the deep ocean, the rapine is now taking its toll.”

With the continental shelves nearly empty, deep-sea trawlers with vast nets scour the deeps. The ocean depths are dark and there is little food. Large predatory fish such as the cod, tuna, and orange roughy, have evolved to a long, slow existence. The orange roughy, fished to near extinction off the coast of Australia and New Zealand, lives to as much as 140 years. It doesn’t reproduce until it is thirty or forty. Cleaning out one year’s population can mean the fish is gone for a century, if it returns at all. Cod, once the commonest fish in the sea, is all but gone. Tuna is well on its way out. The November 3, 2006, New York Times reported:

“If fishing around the world continues at its present pace, more and more species will vanish, marine ecosystems will unravel and there will be ‘global collapse’ of all species currently fished, possibly as soon as midcentury, fisheries experts and ecologists are predicting.” Disputed at the time, what can be said is that world marine fish catch plateaued at the end of the 1980s and has not risen since. Within the captured tonnage the size and value of the fish have sharply declined. Today it takes greater effort to catch many smaller fish as the larger ones are fished out. By 2004 farmed fish constituted two-fifths of the world’s total harvest.

The greatest devastation has taken place off the coast of Southeast Asia, for whose people fish are a major staple. Cribb reports: “In the Gulf of Thailand, Thailand’s most important fisheries location, the density of fish has declined by 86% from 1961 to 1991.” In the world at large, the bigger fish, such as tuna, billfish, snappers, and dories, have become scarce and the total weight of the catch is being made up with anchovies, pilchards, and sardines. And world food consumption is supposed to double by 2050. At least for fish, it can’t happen. And if land-grown meat were to be substituted for fish, the increased demand over the next 38 years would alone consume an additional volume of water “larger than all the irrigation water used worldwide in farming today.” That is equally impossible.

As Cribb summarizes, even if we could continue world sea and freshwater fishing at today’s level, if we could not increase that level and had to substitute land-grown meat to feed our growing population, it takes 22 pounds of grain to produce 2.2 pounds of meat. It would require a billion additional tons of grain a year, twice the current North American annual grain harvest.

But aren’t farmed fish comprising an ever larger portion of the fish in our supermarkets? Yes. Farmed fish amounted to 29% of global fish consumption in 2008. But those fish have to be fed. It takes five tons of wild fish, ground into fish meal, to produce one ton of farmed fish. The only advantage is that farmed fish are easier to catch. Grain can be substituted, but on large scale this competes with all the other uses that are on the razor’s edge of falling short.

There is a still greater threat to our sea life. That is the little-discussed effect on the oceans of the human-caused increase in atmospheric carbon dioxide. Cribb cites a 2005 report by Britain’s Royal Society that determined that the oceans have, over the last two centuries, absorbed a full half of the carbon dioxide produced by human use of fossil fuels. This increases sea water’s acidity, an effect the Royal Society says is “irreversible during our lifetimes. It will take tens of thousands of years for ocean chemistry to return to a condition similar to that occurring at preindustrial times.” (“Ocean Acidification Due to Increasing Atmospheric Carbon Dioxide,” Royal Society policy document, June 2005, cited by Cribb, p. 94.)

The increasing pH dissolves calcium, which is deadly to corals, algae, and plankton that draw carbonates from sea water to build their shells. These tiny organisms are the foundation of the ocean’s food chain. The atmospheric level of CO2 that halts oceanic calcification outright is 500 parts per million; we are at 450 ppm now and headed for 550 in the next thirty-five or forty years.

Julian Cribb reminds us that the greatest extinction in the history of the Earth was not the extermination of the dinosaurs sixty-five million years ago, but the Great Dying at the end of the Permian, 251 million years ago. Then 96 percent of all sea life went extinct, including almost all fish. The cause is debated but is generally believed to have been volcanic eruptions in Siberia that released large amounts of carbon dioxide into the atmosphere. As the corals and other shelled organisms died, the way was cleared for giant bacterial colonies that drained the seas of their oxygen. We are seeing something similar on a smaller scale today as human pollution creates large dead zones in the seas. The recovery time from a mass oceanic extinction, of which there have been five in the Earth’s history, is about ten million years. Cribb quotes Dr. Charlie Veron, Chief Scientist of the Australian Institute of Marine Science: “It cannot rationally be doubted that we are now at the start of an event that has the potential to become the Earth’s sixth mass extinction. . . . It is a case of humans changing the environment.”

What Are We Doing About It?

The Green Revolution of the 1960s and 1970s reduced world hunger from one person in three to one in eight despite population growth. Its success rested on the development of high-yield, disease-resistant wheat. American plant geneticist Norman Borlaug was the central figure in this effort, which was carried out in Mexico, jointly funded by the Mexican government and the Ford and Rockefeller Foundations.

Since the mid-1980s, funding for agricultural research in the United States has been drastically cut. It accounts now for only 1.8 cents of every science dollar. Even more serious, government policy has shifted support from public to private research, an approach almost obsessively endorsed by the Republican Party and its candidates. Julian Cribb is fully supportive of private corporate investment in improving crop yields. But there are key sides to the agrarian crisis in which food producing and marketing corporations have no involvement and to which they make no contribution. As Cribb writes:

“Public research bodies tend to select technologies to work on that deliver public good outcomes, like putting more food on the world’s table, helping the poor, improving health, or curing the environmental impacts of agriculture, whereas private research tends to favor technologies that offer the greatest potential for profit to the investing company.”

Corporate food production research works reasonably well with large, well-funded growers. High royalties on patented seeds and varieties that are sterile, where seeds must be repurchased from the corporation each year, are more likely to be prohibitive for small and subsistence farmers. These small fry may be marginal in the United States but remain the large majority of agrarian producers in sub-Saharan Africa and much of Asia and Latin America.

“These technologies are too costly, are unsuited to small farms, demand extensive training and high educational levels, depend heavily on scarce and expensive inputs based on fossil fuels, or else need to undergo prolonged and expensive adaptation for use in smallholder agriculture – which developing countries’ national agricultural agencies rarely have the resources to carry out.”

Oil for Food

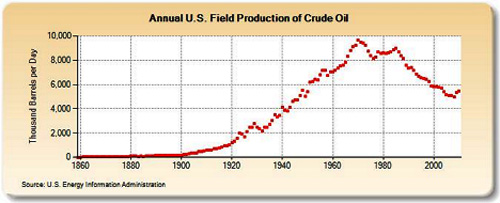

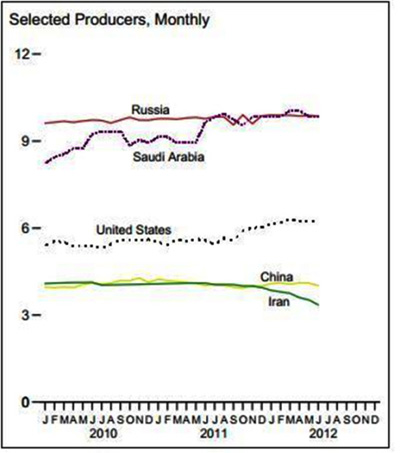

Inevitably any discussion of rising food prices and impending shortages comes around to agriculture’s dependence on oil and the effects of peak oil. As a fossil fuel, the world’s oil is a once-in-a-lifetime treasure that, once spent, will never be there again. A sobering fact for our ever-exploding world population is that it takes 10 calories of fossil oil energy to come up with one calorie of food energy. And here we should turn to Michael Klare’s The Race for What’s Left . The central fact for our oil-dependent civilization is that crude oil, that is, oil that can be pumped out of the ground as a liquid, flatlined globally in 2005 and has not risen since, while both population and demand have continued to grow.

This essential fact has been obscured by a shift to supplement our insufficient crude output with various unconventional alternatives: Canadian tar sands, deep-sea oil, fracked “tight” oil, and corn-based ethanol. The salient point about these alternatives, as Klare explicates, is that they are all far harder to obtain, much more costly, have, with the exception of deep sea, much lower outputs per well, and in some cases lower energy content per barrel. These are the planet’s dregs, after the good stuff is depleted.

As the northern polar ice melts away, a fatal consequence of fossil fuel combustion, the five nations that border the polar sea – Russia, Canada, the United State, Norway, and Greenland (administered by Denmark) – are scrambling to lay rival claims to the ocean floor. Compared to a Texas gusher of a century ago, the efforts to tap oil in the Chukchi and Beaufort Seas off the northern coasts of Alaska and Canada say much about our limited options. Oil drilling has gone on for decades in shallow offshore waters on continental shelves. This is a technology not much different from drilling on land. Deep sea drilling is a wholly other technology. BP’s Deepwater Horizon rig was drilling in 5,000 feet of water and was capable of reaching combined water and under sea land to depths of 30,000 feet. The April 2010 explosion that killed eleven workers took three months to cap, released 4.9 million barrels of oil, devastating sea life and damaging the Gulf tourist industry. The leak is still seeping today.

The point is that even with major cities nearby and clear water the explosion was a historic disaster. Imagine that same explosion in the ice-filled Arctic seas inaccessible to any human habitation larger than a village. Shell Oil has been several years trying to complete a salvage ship that would have some small capacity to confront a major leak, and even then was forced to close its preliminary predrilling preparations in the Chukchi Sea in late summer this year as ice floes threatened the stability of its exploratory operation. Klare writes:

“The pursuit of untapped oil and mineral resources in remote and hazardous locations is part of a larger, more significant phenomenon: a concerted drive by governments and resource firms to gain control over whatever remains of the world’s raw materials base. Government and corporate officials recognize that existing reserves are being depleted at a terrifying pace and will be largely exhausted in the not-too-distant future. The only way for countries to ensure an adequate future supply of these materials, and thereby keep their economies humming, is to acquire new, undeveloped reservoirs in those few locations that have not already been completely drained.”

It is mainly oil that has companies scrabbling in the most dangerous and inhospitable parts of the Earth. Klare continues:

“What we expropriate from these areas represents all that remains of the planet’s once abundant resource bounty. In all likelihood, we are looking at the last oil fields, the last uranium deposits, the last copper mines, and the last reserves of many other vital resources. These materials will not all disappear at once, of course, and some as-yet-undeveloped reserves may prove more prolific than expected. Gradually, though, we will see the complete disappearance of many key resources upon which modern industrial civilization has long relied.”

Central to the multifarious declines is the ravenous pace of extraction, as population burgeoned and standards of living ate up greater and greater resources per capita. Klare offers some figures on the increase in annual production of common minerals for the fifty years from 1950 to 2000. Bauxite went up 1,513%, copper 399%, iron ore 324%, and crude oil 618%.

The consequences are most apparent in oil. The world’s top 10 oil fields have declined from their peak output an average of 30%. Europe’s International Energy Agency estimates the annual decline rate at 6.7%. New discoveries plus unconventional add-ons have kept production flat and even shown a very small increase over the last seven years, but supply is matching demand only because much of the world is still in a steep recession that has driven demand downward.

Other essential materials are heading into decline as well. Klare gives one example:

“In 2005, Indonesia produced 1.1 million metric tons of copper ore, nearly as much as the United States, the world’s second leading producer after Chile. But production has fallen substantially since then, largely as a result of diminishing yields at Freeport-McMoRan’s giant Grasberg mine. According to the U.S. Geological Survey, Indonesia’s net output in 2008 was just 650,000 metric tons, down more than 40 percent in only three years.” Chilean copper output is stagnant despite rising world demand.

The paucity of rare earths is particularly alarming. These are elements with little public recognition: cerium, europium, lanthanum, neodymium. These are essential components in flat screen TVs and computer monitors, lasers, aero-space components, arc lighting, camera lenses, energy efficient light bulbs, catalysts for oil refineries, and high capacity magnets and batteries. They are essential for making cell phones, laptop computers, iPods, and other devices with liquid crystal screens. Michael Klare in his survey tells us that every Prius battery requires two pounds of neodymium and between twenty-two and thirty-three pounds of lanthanum. Rare earths are also used in finishing fine mirrors and glassware. More than 95 percent of commercially available rare earth elements come from China. In November 2010 China cut its rare earth exports by 35 percent, after a three-month total embargo on rare earth shipments to Japan.

Prosperity in our current economies depends on constant economic growth and our species is still in a cycle of constant population expansion. Klare writes:

“According to a projection by the U.S. Department of Energy, worldwide GDP will grow by an estimated 3.4 percent per year between 2008 and 2035, climbing from $66 trillion to $162 trillion over the course of this period (in constant 2005 dollars). Demand for basic resources is bound to expand at a comparable pace, placing extraordinary pressure on energy and mineral producers to find and develop new sources of supply.”

He adds: “According to one estimate, global REE [rare earth elements] demand will jump from 124,000 tons in 2010 to 185,000 tons in 2015, an increase of nearly 50 percent. With consumption increasing so swiftly and Chinese output unlikely to grow, many observers expect to see a high-stakes race among potential REE suppliers around the world.”

The Limitations of

Unconventional Oil

The oil companies have chosen, unwisely for our future, to proclaim that their turn to unconventional oils and oil substitutes will compensate for the decline in traditional crude. They have launched a propaganda campaign centered on a wildly overoptimistic “study” by Italian oil executive Leonardo Maugeri, a visiting scholar at Harvard, which allowed him to get Harvard’s name on his product. Mitt Romney cited this study in his first debate with Barack Obama. Another hustler for the oil companies has been the ultraconservative Wall Street Journal, owned by Rupert Murdoch’s News Corporation, which also owns the far right wing Fox News.

Inasmuch as most Republican politicians are Bible literalists who reject both evolution and geology in favor of young Earth creationism, they are disbelievers in the source of oil in the first place, as the time scales required for its production and the flora and fauna that decomposed to form oil all fall outside of their 7,000 year time frame for the age of our planet, and their reading of the Bible tells them that God would not let us run out of such an essential material. This puts them in a poor position to judge objectively the facts of this issue.

Klare’s summary is as good as any, and represents the views of oil geologists and other experts in this field. Let’s begin with Canadian tar sands. Saudi crude is simply pumped out of the ground. The substance up there in Alberta is not crude oil but bitumen, otherwise known as asphalt, the thick gooey material used to repair roads. It is found mixed with sand, and, in Canada’s chilly climate, is firmly solid. It has to be mined like coal, or heated underground to get it to flow. This requires a large amount of external energy and creates a large amount of environmental damage.

First, the native forest has to be leveled. Then the topsoil is removed, and open pit mining begins. The chunks of asphalt and sand are trucked to a plant where they are ground up and mixed with chemical solvents to create a liquid called syncrude. The wastewater tailings ponds are toxic and kill birds that alight on them.

The alternative method, used where the deposits are too deep for open-pit mining, is to heat vast quantities of water, using steam to melt the underground deposits. The used water is toxic, from chemicals and contact with the liquefied bitumen, so must be stored somewhere indefinitely so it does not contaminate waterways and ground water. Large amounts of natural gas are used to heat the water to make steam.

Another alternative fuel, Venezuela’s heavy oil, presents similar high costs and problems. Heavy oil is found as shallow deposits, formed when regular crude, far in the past, seeped up near the surface, where bacteria and weather removed the lighter components, leaving a thick, viscous material with a high proportion of sulfur and other impurities. Like bitumen, heavy oil must be heated to make it flow, then it is mixed with lighter hydrocarbons such as regular crude to allow it to be run through a pipeline to refineries. Klare adds:

“The necessary amount of such dilution can be quite substantial, with as much as one barrel of diluents required for every three or four barrels of extra-heavy oil produced.”

Deep sea drilling, tar sands, and heavy oil, despite their environmental risks, high costs, and low net energy because of the energy inputs required for their extraction and processing, are known stable technologies. There are two remaining potential fossil fuel energy resources: oil shale and shale oil. The unfortunate reverse terminology can obscure the fact that these are entirely different materials. Oil shale is a name given to kerogen, a substance a few million years short of being naturally cooked into oil. There are vast deposits of this stuff in eastern Utah and western Colorado. Kerogen is a solid. It takes huge quantities of water to extract it, and it is found in mostly desert areas where that volume of water is not available. It must be heated to between 530 and 930 degrees Fahrenheit to become liquid. To date no one has found a way to do anything with it commercially.

For some reason, Klare does not spend any time on shale oil, real oil embedded in limestone shale, being fracked in the Bakken shale of North Dakota and Montana, and the Eagle Ford formation in south Texas. This source accounts for a significant but still relatively modest increase in U.S. crude output that has turned around an almost forty-year decline. It is being vastly overhyped by the media with claims that this will mean oil independence or that the United States will soon be out-producing Saudi Arabia.

Of course the addition to U.S. output is needed and welcome, but it falls far short of the hype. Total production in the Bakken, the largest shale oil play, reached 546,000 barrels per day (b/d) in January 2012, up from 187,000 b/d in 2009. The United States uses 18 million barrels of oil a day, about 40% of that imported. Oil analyst Tom Whipple comments:

” It took the production from 6,617 wells to produce North Dakota’s 546,000 b/d in January. Divide the daily production by the number of wells and you get an astoundingly low 82 b/d from each well. I say ‘astounding’ because a good new offshore well can do 50,000 b/d. BP’s Macondo well which exploded in the Gulf a couple of years ago was pumping out an estimated 53,000 b/d before it was capped. (http://www.fcnp.com/commentary/national/11418-the-peak-oil-crisis-parsing-the-bakken-.html, March 21, 2012)

Not only is the output per well extraordinarily low, the depletion rate of these wells is prohibitive over time. Whipple continues:

“Although a few newly fracked wells may start out producing in the vicinity of 1,000 barrels a day, this rate usually falls by 65 percent the first year; 35 percent the second; and another 15 percent the third. Within a few years most wells are producing in the vicinity of 100 b/d or less which is why the state average for January is only 82 b/d despite the addition of 1300 new wells in 2011. From here on the path ahead seems clear. We seem on course to drill another 2,000 or so in 2012. As long as the price of crude stays up, this pace can continue for a while. The drilling can spread into Montana and Canada until diminishing returns set in. While recently drilled wells may be producing well, the vast bulk of the wells will be close to depletion. While some predict that the Bakken will be producing a million b/d within a few years, it will not stay there long as depletion rates are simply too high.”

Another false hope appeared in a widely reprinted October 23, 2012, Associated Press dispatch by Jonathan Fahey headed “US May Soon Become World’s Top Oil Producer.” It claimed America would soon be out-producing Saudi Arabia. The Saudis pump 11.6 million barrels of crude a day. Fahey gleefully reports that “Driven by high prices and new drilling methods, U.S. production of crude and other liquid hydrocarbons is on track to rise 7 percent this year to an average of 10.9 million barrels per day. . . . the biggest single-year gain since 1951.” He adds an Energy Department forecast that U.S. output will reach 11.4 million barrels a day in 2013.

U.S. output of crude oil, including the recent upturn, is only slightly above 6 million b/d, little more than half of Saudi Arabia’s average, and only amounting to a third of U.S. consumption. The rest of the current 10.9 million daily barrels are those “other” hydrocarbons. Though useful, they are not oil. They include natural gas liquids, mainly propane; biofuels, mainly ethanol; and refinery processing gains. This last doesn’t add any oil; it is the fact that when refining oil into less dense gasoline the total volume increases somewhat as you thin the oil.

And while politicians, particularly Republicans, make a great issue of energy independence, with the United States consuming 25% of the world’s oil it is not going to be free of significant need for imports in the foreseeable future, though it can reduce the current percentage. And oil prices, the main component of gasoline prices, are set globally, so even if we were producing all of our oil needs domestically it would not reduce the price of gasoline.

Getting a Stranglehold on

Other Countries’ Farmland

We return at the end here to the world food crisis. Michael Klare expands on and updates our picture of land-grabs by food-stressed countries of other people’s arable land. The global leap in food prices in 2008 left Saudi Arabia at the mercy of international grain merchants, many of whom had run out and could not ship anything. Several Saudi companies, backed by the government’s King Abdullah Initiative for Saudi Agricultural Investment Abroad, have bought up large foreign landholdings. Saudi Star owns 750,000 acres in Ethiopia, where it is producing rice on one 25,000 acre parcel. Hadco is growing wheat, corn, and soybeans on 22,800 acres in Sudan. Klare writes:

“The proliferation of Saudi agricultural projects in desperately poor African nations such as Sudan and Ethiopia has produced some striking scenes. Nancy Macdonald of Maclean’s , who visited the Saudi Star pilot operation in Alwero, described guards with AK-47s protecting humidity-controlled greenhouses that are watered by computerized irrigation systems – high-tech plantations set in the middle of a country where farming is still conducted with sickles and ox-drawn plows and where millions suffer from chronic malnutrition.”

Sudan has sold or leased 245,000 acres to Qatar and 700,000 to the United Arab Emirates, which also controls 100,000 acres in Egypt. The UAE’s Minerals Energy Commodities Holding Company has leased 245,000 acres in Indonesia. Bigger players – China, India, and South Korea – are also buying up or leasing acreage. Klare reports that the South Korean government is providing backing to some sixty South Korean companies running farms in sixteen foreign countries. In Madagascar, the Daewoo Logistics Corporation, part of the giant Daewoo conglomerate, in 2008 secured a lease on 3.2 million acres of farmland, where it planned to grow 50 percent of South Korea’s corn. This sparked a popular rebellion that forced President Marc Ravalomanana out of office in March 2009. His successor canceled the contract.

South Korea then moved on to Sudan, where its companies gained control of 1.7 million acres. Hyundai Heavy Industries Company is acquiring thousands of acres in Siberia. “Another branch of the same conglomerate,” Klare writes, “is planning to buy large parcels of farmland in Brazil. With strong government support, South Korean firms aim to control a combined one million acres of foreign farmland by 2018, enabling them to supply 10 percent of the country’s annual imports of corn, wheat, and soybeans.”

India and China between them have 2.6 billion people and rising. India is expected to add 300 million by 2050. And the Green Revolution has reached its limits. Making any noticeable contribution to the food resources of such giants could drain many small countries dry. But India, through its state-owned Minerals and Metals Trading Corporation of India, is buying up land across Africa: in Tanzania, Ethiopia, Kenya, Malawi, and Mozambique. One private Indian firm, Karuturi Global, based in Bangalore, has bought 770,000 acres in Ethiopia.

China has adopted a “go outward” strategy that Klare says is being carried out “on an enormous scale and with blistering speed.” The state-owned Chongqing Grain Group Company is investing $2.5 billion in soybean production on 500,000 acres in Brazil. They expect to process two million tons a year. Another company is investing $7 billion in another area in Brazil. China is also pursuing large tracts of land in Africa, in Mozambique, Benin, Cameroon, Mali, Uganda, and the Democratic Republic of the Congo. They have leased 250,000 acres in Zimbabwe to grow corn. The Beidahuang Land Cultivation Group, the major agricultural power in Heilongjiang province, is making large investments in leasing or purchasing farmland in Venezuela, Zimbabwe, Australia, Brazil, Argentina, Russia, and the Philippines.

Some of the largest land transfers have taken place in the Democratic Republic of the Congo, which has ceded 7 million acres to a Chinese company; Kenya, where Canadian, British, and Qatari companies have heavy investments; Liberia, where a Malaysian company has a sixty-three-year lease on 545,000 acres; and Senegal, where the Saudis are acquiring a million acres.

Former Soviet collective farms, abandoned since the fall of communism, are also on the block to foreigners.

Private companies, including American hedge funds, are making similar investments. One securities consultant has coined the term “peak soil” to describe the world scramble for the last remaining farmland. Klare points to Susan Payne, CEO of the British giant Emergent Asset Management, which is making extensive investment in foreign croplands and holds 370,000 acres of good farmland in southern Africa:

“Payne’s views on global food availability combine the nineteenth-century precepts of Thomas Malthus – who predicted that overpopulation would inevitably lead to mass starvation – with twenty-first-century statistics showing declining water levels in China and India, increasing desertification from global warming, and, of course, global population levels rising by some 80 million people per year. All of these factors, Payne explains, could lead to significant food shortages by 2020, giving anyone who controls large areas of farmland the chance to accrue colossal profits.”

With 100,000 acres here and 500,000 there, the global totals of foreign cropland purchased have become enormous. A World Bank study reports that these trades were running at 10 million acres a year until 2008, then leaped to 110 million acres in 2009, an area, as Klare notes, the size of Sweden. ( Rising Global Interest in Farmland , Klaus Deninger and Derek Byerlee. Washington, DC: The World Bank, 2011, 264 pp.)

Klare concludes:

“For all the importance and forthcoming scarcity of oil, gas, and vital minerals, perhaps the fiercest resource struggle in the coming decades will involve food and the land it is grown on.”

A bitter struggle is implicit between the governments of the land hungry nations that are laying claim to other people’s land, and the indigenous populations, often forced off their traditional lands by their own corrupt governments to complete these transactions. And these are only the trigger points of a far wider threat of famine. As population growth, water scarcity, and global warming press harder on our limited and declining resources terrible contests, literally for survival, will be waged. Even rich America, though it may not see the worst of this, is not likely to be spared.